Name any major tech brand – from Google to Amazon to Tesla to ChatGPT – and the chances are Nvidia is involved in some way.

The company – which makes computer chips – may not be a household name in the UK, but it has just leapfrogged Microsoft and Apple to become the most valuable public company in the world.

Update:

Microsoft back as world’s most valuable company

It is now worth more than $3.3tn (£2.6tn) – with its share price up by almost 600,000% from when it first traded on the US stock market back in 1999.

If you had invested $10,000 (£7,850) in the firm back then, the stock would now be worth more than $59m (£46m).

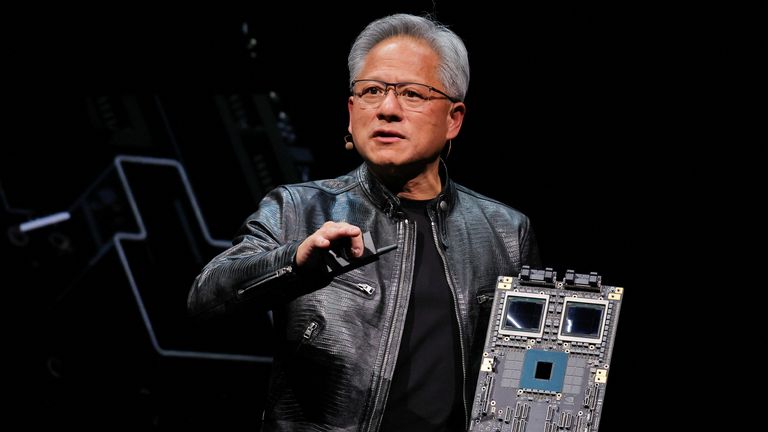

Jensen Huang, the co-founder and chief executive of Nvidia, has also seen his net worth swell to a staggering $119bn (£93bn) as a result, according to Forbes.

But how did this all happen?

Next version envy

Nvidia was formed in 1993 when Mr Huang met up with two friends – all of them engineering graduates – at a Denny’s restaurant in California.

The multi-billionaire used to work at a branch of the chain when he was a teenager after immigrating to the US with his family from Taiwan.

Video games were the initial focus of the trio, who wanted to create a computer chip that would help PCs display “realistic” 3D graphics.

Mr Huang, 61, said the 24-hour diner was an ideal meeting place because it had “all the coffee you could drink and no one could chase you out”.

The caffeine-fuelled session spurred Mr Huang, along with friends Chris Malachowsky and Curtis Priem, to soon get down to business working out of an apartment in Fremont, California.

They came up with the name Nvidia by combining NV – which stands for “next version” – with “Invidia”, the Latin word for envy.

The friends hoped to speed up computing so much that they would leave their rivals in the dust looking on – a mentality that also inspired the firm’s logo, which features an envious “green” eye.

Intelligent chips

In the 1990s the computer chip market was dominated by companies such as Intel, a key producer of central processing units (CPUs), a key foundation of basic computing and software processes.

However, Nvidia managed to carve out a specialism for itself by instead focusing on graphics processing units (GPUs), which are an important element in computer games as they help render images.

The company built up a reputation for helping to revolutionise electronic entertainment and went public in 1999.

Nvidia’s early success included its graphics card GeForce, which can be plugged into a PC to increase its power.

Writer Stephen Witt said the early popularity of the device was particularly driven by the Quake series of first-person shooter games.

The company soon achieved another coup when it signed up to become the exclusive graphics provider for Microsoft’s first Xbox games console in 2000.

However, it soon emerged that the company’s GPUs could also be useful beyond shoot ’em ups, platformers and role-playing games.

Clever bet

Engineers realised that the chips were able to perform calculations in ways regular CPUs could not – making them more energy efficient and better able to handle sophisticated computing tasks.

So by the mid-2000s Nvidia began marketing its products at other types of tech firms, before then branching out further by investing heavily in artificial intelligence (AI) in the 2010s.

One example was car companies – which soon turned to the firm for help with driver-assistance software. The impact was so major that Nvidia’s hardware is now found in all Tesla vehicles.

The company was also able to use its dominant and advanced position on GPUs to steal a march on its rivals, producing its chips more quickly and in larger volumes.

However, it was the company’s early gamble with AI, such as through developing machine-learning features in its products, which propelled it to the top.

Mr Huang told Sky News’ US partner NBC News in an interview last year: “We just believed that someday something new would happen, and the rest of it requires some serendipity.”

When asked if the company’s subsequent success with AI was the result of luck or prescience, he replied: “It wasn’t foresight. The foresight was accelerated computing.”

Bryan Catanzaro, who began working on AI when he joined Nvidia in 2008, told NBC News: “For 10 years, Wall Street asked Nvidia, ‘Why are you making this investment? No one’s using it’.”

From billions to trillions

The company’s journey to the king of the stock market has not been without its stumbles.

In 2010 it made an unsuccessful attempt to muscle in on the smartphone market – with Mr Huang admitting that he has made “a lot” of mistakes over the years.

But by the time of the COVID-19 pandemic in 2020, firms began increasingly turning to AI – and Nvidia’s bet started to pay off.

Among the firms using its technology was ChatGPT, which was soon followed by a rush of imitators.

A Wall Street analyst told the New Yorker last year: “There’s a war going on out there in AI, and Nvidia is the only arms dealer.”

Today, seemingly every major company in Silicon Valley, including Amazon, Google, Meta and Microsoft, has made use of its chips, and it is estimated to control more than 80% of the market for the tech used in AI systems.

Nvidia’s success has only accelerated in recent months. It hit a market valuation of $2tn in February and then overtook Apple for the number two spot earlier this month.

It finally climbed to the summit of the stock market on Tuesday after adding more than $100bn (£79bn) to its market value in just one day.

Analysts said demand had been fuelled by a stock split earlier this month that created more shares and made them more attractive to individual investors.

However, while demand for Nvidia’s products is currently outstripping supply, its top spot will likely continue to be threatened in the coming months and years as firms such as Microsoft invest heavily in AI in an attempt to catch up.